Typically How Much Is Allowed Family Member Allowance in Probate Idaho

This guide is intended to provide American Indian and Alaska Native (AI/AN) trust or restricted landowners with basic data about the Department of the Interior's (DOI) probate process. This information pertains only to the probate of Trust or Restricted Lands and Trust Personalty equally defined by 25 CFR part 15 and 43 CFR part 30.

This guide is for informational purposes only and is non intended to provide legal advice. Probate laws tin can and do alter and are sometimes complex. Each case is unique and may have special factors; therefore, if you want professional advice for your legal state of affairs you should seek the advice and counsel of an chaser.

You may phone call or visit your local Agency of Indian Diplomacy Agency role (Agency), Tribal Probate Program part, Office of the Special Trustee for American Indians (OST), or Office of Hearings and Appeals (OHA) for more information.

Table of Contents:

Page links:

What is a Probate?

Who will process the probate?

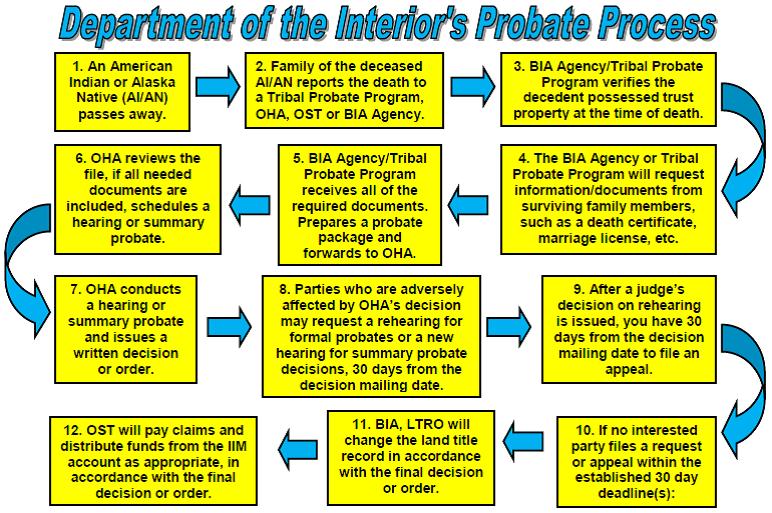

What are the bones steps of the probate process?

Why is it taking and so long?

What assets will the Secretary probate? 25 CFR part 15, § 15.x

What are the basic steps of the probate process? 25 CFR part 15, § fifteen.eleven

What happens if assets in a trust estate may be diminished or destroyed while the probate is awaiting? 25 CFR part fifteen, § fifteen.12

How do I begin the probate process? 25 CFR part xv, § 15.103

Does the agency need a death certificate to ready a probate file? 25 CFR office 15, § 15.104

What other documents does the agency need to ready a probate file? 25 CFR role xv, § xv.105

May a probate case exist initiated when an possessor of an interest has been absent? 25 CFR office 15, § 15.106

What happens later the probate file is referred to OHA? 25 CFR part fifteen, § fifteen.402

May I receive funds from the decedent's IIM account for funeral services? 25 CFR part xv, § 15.301

May I file a claim confronting an manor? 25 CFR part 15, § xv.302

What happens if there is not enough trust personalty to pay all the claims? 43 CFR part thirty, § 30.147

How may I notice out the status of a probate? 25 CFR part 15, § xv.501

Will I receive discover of the probate proceeding? 43 CFR part 30, § 30.114

What action will the judge take if the interested parties agree to settle matters among themselves? 43 CFR part 30, § 30.150

What is a summary probate proceeding? 43 CFR function 30, § 30.200

How will I receive notice of the formal probate proceeding? 43 CFR office 30, § xxx.210

How may I obtain documents related to the probate proceeding? 43 CFR role 30, § 30.215

Must testimony in a probate proceeding be under oath or affirmation? 43 CFR part 30, § 30.225

What observe of the determination will the approximate provide? 43 CFR part thirty, § xxx.237

What happens after the probate society is issued? 25 CFR role 15, § 15.403

May I file a petition for rehearing if I disagree with the gauge's decision in the formal probate hearing? 43 CFR role 30, § xxx.238

Does any distribution of the estate occur while a petition for rehearing is pending?43 CFR part 30, § 30.239

May a judge reopen a probate case to correct errors and omissions? 43 CFR part 30, § 30.125

May a airtight probate case be reopened? 43 CFR role 30, § thirty.243

What happens if the approximate reopens the example? 43 CFR part 30, § 30.245

How must minors or other legal incompetents exist represented? 43 CFR role thirty, § 30.253

Contact Data

12 Regions

Definitions

What is a Probate?

25 CFR part 15 defines a Probate equally:

"Probate ways the legal process by which applicable tribal, Federal, or State constabulary that affects the distribution of a decedent'southward estate is applied in order to:

(1) Determine the heirs;

(2) Determine the validity of wills and decide devisees;

(three) Make up one's mind whether claims against the estate will be paid from trust personalty*; and

(iv) Social club the transfer of any trust or restricted country or trust personalty to the heirs, devisees, or other persons or entities entitled by law to receive them."

*For purposes of this guide "trust personalty" will be referred to as "trust funds" throughout the remainder of this guide.

In other words, when an AI/AN passes away and endemic trust or restricted lands and/or trust funds at the time of death, there must be a way of transferring the trust lands/funds to the deceased person'due south heirs or to whoever is to take buying nether the terms of a will. OHA will determine what trust lands/funds the deceased person endemic, determine the deceased person'southward legal heirs or devisees and order distribution of the trust or restricted lands or funds to the advisable persons.

Every bit you can come across the probate of trust or restricted land and trust funds uses legal terms such as "heirs" and "devisees", delight see the Definitions section in this booklet for an explanation of these terms. (Table of Contents)

Who volition process the probate?

Several federal agencies within the DOI are involved in the probate of an AI/AN's trust or restricted property and trust funds. Below are the agencies/tribal programs that are involved in the probate process along with a brief description of their part in this process:

- DOI, Bureau of Indian Diplomacy and/or Tribes (tribes that contract or compact with the Federal authorities for the BIA's probate function). For purposes of this brochure, the word Agency applies to both the BIA Bureau Office and Tribes that contract or compact with the Federal government.

- Agency learns of, or receives notification of, an AI/AN's death and verifies.

- Bureau determines if the decedent owned trust or restricted belongings and/or trust funds at the time of his/her death. Requests and/or gathers the appropriate documents and prepares a probate file according to the regulation.

- Agency refers the completed probate file to OHA for consignment to a approximate or Attorney Conclusion Maker (ADM).

- Subsequently the OHA judge or ADM issues a decision, the BIA, Land Titles and Records Part (LTRO) will update the state title record of the deceased AI/AN's trust or restricted holding to reflect the heirs or devisees as the current owners.

- DOI, Office of Hearings and Appeals (OHA)

- OHA guess or ADM decides how the trust or restricted lands and/or trust funds will be distributed amidst the eligible heirs or devisees.

- DOI, Role of the Special Trustee for the American Indians (OST)

- After the OHA approximate or ADM issues the decision, and following any appeals, OST volition distribute the avails in the deceased AI/AN's Individual Indian Money (IIM) account to the eligible heirs or devisees listed in OHA's determination. (Table of Contents)

What are the basic steps of the probate procedure?

This illustration is intended to show but the very basic steps of the probate process. Delight see 25 CFR part xv and 43 CFR part 30 for more than data regarding the probate process. (Table of Contents)

Why is information technology taking then long?

One of the most ofttimes asked questions is, "Why does information technology accept so long to complete the probate procedure?" There is no set time frame for the process of probating trust or restricted lands and/or trust funds. The completion of a probate requires the coordination and collaboration of the Agency, LTRO, OHA, and OST. Gathering the required documents such as death certificates, marriage licenses, and adoption decrees requires the cooperation of the decedent'southward heirs. The gathering of these documents can sometimes take months to complete; therefore, information technology is of import that interested parties respond to requests for information in a timely manner.

When the Agency has gathered all of the required documents, they will forward the probate package to OHA for adjudication. OHA will review, prioritize, and ultimately schedule the manor for a formal hearing or summary probate. There is no set fourth dimension frame for the scheduling of hearings. OHA sometimes returns probate packages to the Agency for clarification and/or further documentation; this tin cause delays in the scheduling of the hearing.

In one case OHA issues an Gild, an interested party may appeal OHA's Order which can result in further delays. Some cases are more than complex than others, requiring more review fourth dimension, and the entire process tin can, at times, take a yr or more to consummate. In one case the OHA Society is final, LTRO volition update the state title record to reflect OHA's Lodge and OST volition distribute the trust funds from the estate.

The following Question & Answers are from the Code of Federal Regulations (CFR).

What avails will the Secretarial assistant probate? 25 CFR office 15, § 15.10

(a) Nosotros will probate only the trust or restricted land, or trust personalty owned past the decedent at the time of expiry.

(b) We will non probate the post-obit property:

(1) Real or personal property other than trust or restricted country or trust personalty endemic by the decedent at the time of decease;

(two) Restricted land derived from allotments made to members of the Five Civilized Tribes (Cherokee, Choctaw, Chickasaw, Creek, and Seminole) in Oklahoma; and

(3) Restricted interests derived from allotments made to Osage Indians in Oklahoma (Osage Nation) and Osage headright interests owned by Osage decedents.

(c) We will probate that role of the country and assets owned past a deceased fellow member of the Five Civilized Tribes or Osage Nation who owned a trust interest in land or a restricted involvement in country derived from an individual Indian who was a member of a Tribe other than the 5 Civilized Tribes or Osage Nation. (Tabular array of Contents)

What are the basic steps of the probate procedure? 25 CFR part fifteen, § xv.xi

The basic steps of the probate process are:

(a) We learn nigh a person's death;

(b) We prepare a probate file that includes documents sent to the agency;

(c) We refer the completed probate file to OHA for consignment to a judge or ADM; and

(d) The judge or ADM decides how to distribute whatever trust or restricted state and/or trust personalty, and nosotros brand the distribution. (Table of Contents)

What happens if avails in a trust estate may be diminished or destroyed while the probate is pending? 25 CFR part 15, § xv.12

(a) This department applies if an interested political party or BIA:

(ane) Learns of the death of a person owning trust or restricted property; and

(2) Believes that an emergency exists and the avails in the estate may be significantly macerated or destroyed before the final decision and social club of a judge in a probate instance.

(b) An interested political party, the Superintendent, or other authorized representative of BIA has standing to request relief.

(c) The interested party or BIA representative may asking:

(1) That OHA immediately assign a judge or ADM to the probate case;

(2) That BIA transfer a probate file to OHA containing sufficient information on potential interested parties and documentation concerning the alleged emergency for a judge to consider emergency relief in order to preserve estate assets; and

(iii) That OHA hold an expedited hearing or consider ex parte relief to preclude impending or further loss or destruction of trust assets. (Table of Contents)

How practise I begin the probate procedure? 25 CFR part 15, § 15.103

As shortly every bit possible, contact any of the post-obit offices to inform us of the decedent'southward expiry:

(a) The bureau or BIA regional function nearest to where the decedent was enrolled;

(b) Any agency or BIA regional office; or

(c) The Trust Beneficiary Call Center in OST.

(Anyone may notify us of a death and there is no deadline to notify u.s.; however, notifying us as soon as possible assures a more timely distribution of the estate.) (Table of Contents)

Does the agency need a death certificate to prepare a probate file? 25 CFR part 15, § 15.104

(a) Yep. You must provide us with a certified copy of the death document if a decease certificate exists. If necessary, we will make a re-create from your certified copy for our use and return your copy.

(b) If a decease certificate does non exist, you must provide an affirmation containing equally much data equally y'all accept apropos the deceased, such as:

(1) The State, city, reservation, location, date, and cause of death;

(2) The last known address of the deceased;

(3) Names and addresses of others who may take data almost the deceased; and

(4) Any other information that is available concerning the deceased, such as newspaper articles, an obituary, death notices, or a church or court record. (Tabular array of Contents)

What other documents does the agency need to prepare a probate file? 25 CFR part 15, § 15.105

In addition to the certified re-create of a death certificate or other reliable evidence of death listed in §15.104, we demand the post-obit information and documents:

(a) Originals or copies of all wills, codicils, and revocations, or other testify that a volition may exist;

(b) The Social Security number of the decedent;

(c) The place of enrollment and the tribal enrollment or demography number of the decedent and potential heirs or devisees;

(d) Current names and addresses of the decedent'southward potential heirs and devisees;

(e) Any sworn statements regarding the decedent'southward family, including any statements of paternity or motherhood;

(f) Any statements renouncing an interest in the manor including identification of the person or entity in whose favor the interest is renounced, if any;

(g) A list of claims by known creditors of the decedent and their addresses, including copies of whatever court judgments; and

(h) Documents from the appropriate government, certified if possible, concerning the public record of the decedent, including but not limited to, whatsoever:

(ane) Marriage licenses and certificates of the decedent;

(2) Divorce decrees of the decedent;

(three) Adoption and guardianship records concerning the decedent or the decedent's potential heirs or devisees;

(4) Use of other names by the decedent, including copies of name changes by court order; and

(v) Orders requiring payment of child support or spousal back up. (Tabular array of Contents)

May a probate case be initiated when an owner of an involvement has been absent-minded? 25 CFR part xv, § 15.106

(a) A probate instance may be initiated when either:

(one) Data is provided to u.s. that an possessor of an interest in trust or restricted land or trust personalty has been absent without caption for a menses of at least half dozen years; or

(2) Nosotros become enlightened of other facts or circumstances from which an inference may be fatigued that the person has died.

(b) When nosotros receive information every bit described in §xv.106(a), we may begin an investigation into the circumstances, and may try to locate the person. We may:

(1) Search bachelor electronic databases;

(2) Inquire into other published information sources such as telephone directories and other bachelor directories;

(3) Examine BIA state title and lease records;

(4) Examine the IIM account ledger for disbursements from the account; and

(5) Engage the services of an independent firm to bear a search for the owner.

(c) When we have completed our investigation, if we are unable to locate the person, we may initiate a probate instance and prepare a file that may include all the documentation developed in the search.

(d) Nosotros may file a merits in the probate case to recover the reasonable costs expended to contract with an independent firm to comport the search. (Tabular array of Contents)

What happens after the probate file is referred to OHA? 25 CFR part 15, § 15.402

When OHA receives the probate file from BIA, information technology volition assign the case to a judge or ADM. The estimate or ADM will acquit the probate proceeding and issue a written decision or order, in accordance with 43 CFR part thirty. (Table of Contents)

May I receive funds from the decedent's IIM business relationship for funeral services? 25 CFR office fifteen, § fifteen.301

(a) Y'all may request an corporeality of no more than $1,000 from the decedent'south IIM account if:

(1) You are responsible for making the funeral arrangements on behalf of the family of a decedent who had an IIM account;

(2) Y'all take an firsthand need to pay for funeral arrangements earlier burying; and

(iii) The decedent's IIM business relationship contains more than than $two,500 on the appointment of expiry.

(b) Yous must utilize for funds nether paragraph (a) of this section and submit to us an original itemized estimate of the cost of the service to be rendered and the identification of the service provider.

(c) We may approve reasonable costs of no more than $1,000 that are necessary for the burial services, taking into consideration:

(1) The total amount in the IIM account;

(ii) The availability of non-trust funds; and

(three) Whatever other relevant factors.

(d) We will make payments directly to the providers of the services. (Table of Contents)

May I file a claim against an estate? 25 CFR role fifteen, § 15.302

If a decedent owed y'all money, you may make a claim against the estate of the decedent.

Please see §§fifteen.303, 15.304, and fifteen.305 to discover out where, when and what must exist included in your merits against an estate.

(Table of Contents)

What happens if in that location is not plenty trust personalty to pay all the claims? 43 CFR role 30, § xxx.147

If, equally of the date of death, there was not plenty trust personalty to pay all immune claims, the gauge may order them paid on a pro rata basis. The unpaid residual of any claims will not be enforceable against the manor afterwards the manor is closed. (Table of Contents)

How may I observe out the status of a probate? 25 CFR part 15, § fifteen.501

You may go information almost the status of an Indian probate by contacting whatsoever BIA agency or regional office, an OST fiduciary trust officer, OHA, or the Trust Casher Telephone call Middle in OST. (Table of Contents)

Will I receive observe of the probate proceeding? 43 CFR office 30, § thirty.114

(a) If the instance is designated as a formal probate proceeding, OHA will transport a notice of hearing to:

(i) Potential heirs and devisees named in the probate file;

(2) Those creditors whose claims are included in the probate file; and

(iii) Other interested parties identified past OHA.

(b) In a instance designated a summary probate proceeding, OHA will transport a detect of the designation to potential heirs and devisees and volition inform them that a formal probate proceeding may exist requested instead of the summary probate proceeding. (Table of Contents)

What activity will the judge take if the interested parties agree to settle matters amid themselves? 43 CFR part xxx, § 30.150

(a) A judge may corroborate a settlement agreement amongst interested parties resolving any issue in the probate proceeding if the judge finds that:

(1) All parties to the agreement are advised as to all fabric facts;

(2) All parties to the agreement understand the effect of the agreement on their rights; and

(3) It is in the all-time interest of the parties to settle.

(b) In considering the proposed settlement agreement, the judge may consider evidence of the corresponding values of specific items of property and all encumbrances.

(c) If the judge approves the settlement agreement under paragraph (a) of this section, the judge volition issue an social club approving the settlement agreement and distributing the manor in accord with the agreement. (Table of Contents)

What is a summary probate proceeding? 43 CFR function xxx, § 30.200

(a) A summary probate proceeding is the disposition of a probate instance without a formal hearing on the basis of the probate file received from the bureau. A summary probate proceeding may exist conducted by a judge or an ADM, as determined by the supervising judge.

(b) A decedent'southward estate may be processed summarily if the estate involves simply cash and the total value of the estate does not exceed $five,000 on the date of expiry. (Table of Contents)

How will I receive notice of the formal probate proceeding? 43 CFR part xxx, § 30.210

OHA will provide notice of the formal probate proceeding nether §30.114(a) by mail and by posting. A posted and published notice may contain notices for more than one hearing, and need merely specify the names of the decedents, the captions of the cases and the dates, times, places, and purposes of the hearings.

(a) The notice must:

(1) Be sent by starting time class mail;

(2) Be sent and posted at least 21 days before the date of the hearing; and

(iii) Include a document of mailing with the date of mailing, signed past the person mailing the notice.

(b) A presumption of actual notice exists with respect to any person to whom OHA sent a observe under paragraph (a) of this section, unless the observe is returned past the Postal Service every bit undeliverable to the addressee.

(c) OHA must post the discover in each of the following locations:

(i) Five or more conspicuous places in the vicinity of the designated place of hearing; and

(2) The bureau with jurisdiction over each bundle of trust or restricted belongings in the manor.

(d) OHA may also post the notice in other places and on other reservations as the approximate deems appropriate. (Tabular array of Contents)

How may I obtain documents related to the probate proceeding? 43 CFR part 30, § thirty.215

(a) You may make a written demand to produce documents for inspection and copying. This demand:

(1) May be made at any phase of the proceeding before the conclusion of the hearing;

(2) May be made on any other party to the proceeding or on a custodian of records concerning interested parties or their trust holding;

(3) Must be made in writing, and a copy must be filed with the judge; and

(4) May demand copies of any documents, photographs, or other tangible things that are relevant to the problems, non privileged, and in some other party's or custodian's possession, custody, or control.

(b) Custodians of official records will furnish and reproduce documents, or let their reproduction, nether the rules governing the custody and control of the records.

(i) Subject to any law to the contrary, documents may be fabricated bachelor to any member of the public upon payment of the cost of producing the documents, every bit adamant reasonable past the custodians of the records.

(2) Information inside federal records will exist maintained and disclosed as provided in 25 The statesC. 2216(e), the Privacy Human action, and the Freedom of Data Human activity. (Table of Contents)

Must testimony in a probate proceeding be under oath or affirmation? 43 CFR part xxx, § thirty.225

Yes. Testimony in a probate proceeding must exist under oath or affirmation. (Table of Contents)

What detect of the decision will the judge provide? 43 CFR part 30, § 30.237

When the estimate issues a decision, the judge must mail or deliver a find of the decision, together with a copy of the decision, to each affected agency and to each interested political party. The observe must include a statement that interested parties who are adversely afflicted accept a right to file a petition for rehearing with the gauge within thirty days later the date on which observe of the determination was mailed. The determination will go final at the end of this thirty-day menstruation, unless a timely petition for rehearing is filed with the guess. (Table of Contents)

What happens after the probate order is issued? 25 CFR part 15, § 15.403

(a) If the probate decision or order is issued past an ADM, you take thirty days from the decision mailing date to file a written request for a de novo review.

(b) If the probate decision or guild is issued by a estimate, y'all have 30 days from the decision mailing date to file a written asking for rehearing. Afterwards a guess's decision on rehearing, you take 30 days from the mailing date of the decision to file an appeal, in accordance with 43 CFR parts four and 30.

(c) When any interested political party files a timely request for de novo review, a request for rehearing, or an entreatment, nosotros will not pay claims, transfer title to land, or distribute trust personalty until the request or appeal is resolved.

(d) If no interested party files a request or appeal within the 30-day deadlines in paragraphs (a) and (b) of this section, we will wait at least fifteen additional days before paying claims, transferring title to country, and distributing trust personalty. At that time:

(1) The LTRO volition modify the country championship records for the trust and restricted land in accordance with the concluding decision or order; and

(two) We will pay claims and distribute funds from the IIM account in accordance with the final decision or order. (Table of Contents)

May I file a petition for rehearing if I disagree with the judge'due south determination in the formal probate hearing? 43 CFR part xxx, § 30.238

(a) If yous are adversely affected by the determination, you may file with the approximate a written petition for rehearing within xxx days after the engagement on which the conclusion was mailed under §30.237.

(b) If the petition is based on newly discovered bear witness, it must:

(ane) Be accompanied by one or more than affidavits of witnesses stating fully the content of the new evidence; and

(ii) State the reasons for the failure to discover and present that evidence at the hearings held before the issuance of the determination.

(c) A petition for rehearing must country specifically and concisely the grounds on which it is based.

(d) The judge must forrard a copy of the petition for rehearing to the afflicted agencies. (Tabular array of Contents)

Does whatsoever distribution of the estate occur while a petition for rehearing is pending? 43 CFR part 30, § 30.239

The agencies must not initiate payment of claims or distribute whatever portion of the manor while the petition is pending, unless otherwise directed by the judge. (Table of Contents)

May a approximate reopen a probate example to right errors and omissions? 43 CFR part 30, § xxx.125

(a) On the written request of an interested party, or on the basis of the judge'south own order, at whatsoever time, a guess has the authority to reopen a probate case to:

(1) Determine the correct identity of the original allottee, or whatever heir or devisee;

(2) Make up one's mind whether different persons received the same allotment;

(3) Decide whether trust patents covering allotments of land were issued incorrectly or to a non-existent person; or

(iv) Determine whether more than than one allocation of land had been issued to the aforementioned person under unlike names and numbers or through other errors in identification.

(b) The judge will notify interested parties if a probate case is reopened and volition conduct appropriate proceedings nether this part. (Tabular array of Contents)

May a closed probate case be reopened? 43 CFR part 30, § xxx.243

(a) The guess may reopen a closed probate example every bit shown in the following table.

| How the example can be reopened | Applicative deadline | Standard for reopening the case |

| (1) On the judge'due south own motion | (i) Initiated within iii years after the date of the original decision | To correct an fault of fact or law in the original decision. |

| (2) Initiated more than 3 years after the date of the original conclusion | To right an mistake of fact or law in the original determination which, if non corrected, would result in a manifest injustice. | |

| (2) On a petition filed by the agency | (i) Filed within iii years after the date of the original decision | To right an mistake of fact or law in the original decision. |

| (ii) Filed more than 3 years later the date of the original decision | To correct an fault of fact or law in the original decision which, if not corrected, would result in a manifest injustice. | |

| (3) On a petition filed past the interested party | (i) Filed within 3 years later the engagement of the original decision and within 1 year subsequently the petitioner's discovery of an alleged error | To right an mistake of fact or law in the original decision. |

| (two) Filed more than 3 years afterwards the date of the original conclusion and inside 1 year after the petitioner'due south discovery of an alleged error | To right an error of act or law in the original determination which, if non corrected, would event in a manifest injustice. |

(c) A petition filed by an interested party must:(b) All grounds for reopening must be set forth fully in the petition.

(1) Include all relevant evidence, in the class of documents or affidavits, concerning when the petitioner discovered the declared error; and

(2) If the grounds for reopening are based on declared errors of fact, be supported by affirmation. (Table of Contents)

What happens if the judge reopens the case? 43 CFR part 30, § 30.245

On reopening, the judge may affirm, change, or vacate the former decision.

(a) The concluding order on reopening must include a notice stating that interested parties who are adversely affected have a correct to appeal the concluding club to the Board within 30 days of the date on which the order was mailed, and giving the Board's address.

(b) Copies of the judge's decision on reopening must exist mailed to the petitioner and to all persons who received copies of the petition.

(c) Past order directed to the agency, the judge may suspend further distribution of the manor or income during the reopening proceedings.

(d) The gauge must file the record made on a reopening petition with the designated LTRO and must replenish a duplicate record to the affected agencies.(Table of Contents)

How must minors or other legal incompetents be represented? 43 CFR part thirty, § 30.253

Minors and other legal incompetents who are interested parties must be represented by legally appointed guardians, or past guardians ad litem appointed past the judge. In appropriate cases, the judge may society the payment of fees to the guardian ad litem from the assets of the estate. (Tabular array of Contents)

Contact Data

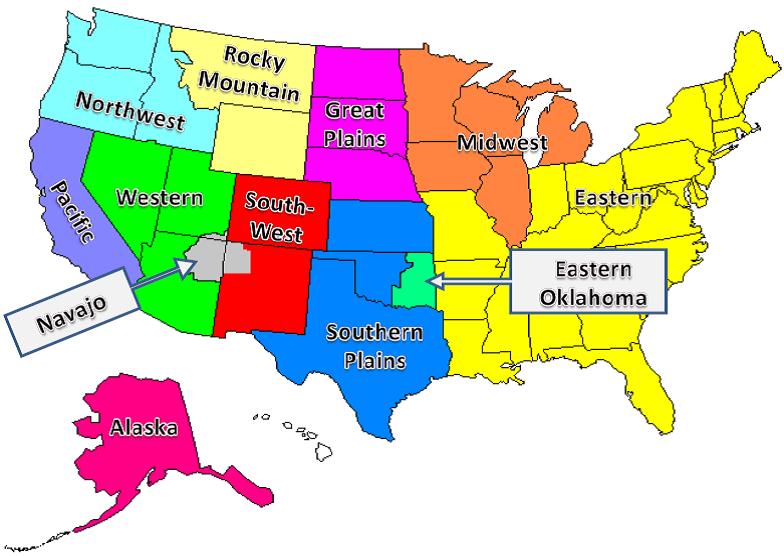

Beneath is a map of the 12 BIA Regions and the contact data for the BIA Division of Probate & Estate Services function located at each Regional Office.(Table of Contents)

| BIA Regional Part | Location | DPES Phone # |

| Alaska | Juneau, Alaska | (907) 271-3911 |

| Eastern | Nashville, Tennessee | (615) 564-6770 |

| Eastern Oklahoma | Muskogee, Oklahoma | (918) 781-4611 |

| Great Plains | Aberdeen, South Dakota | (605) 226-7665 |

| Midwest | Bloomington, Minnesota | (612) 725-4500 |

| Navajo | Gallup, New Mexico | (928) 871-5935 |

| Northwest | Portland, Oregon | (503) 231-2276 |

| Pacific | Sacramento, California | (916) 978-6070 |

| Rocky Mount | Billings, Montana | (406) 247-7907 |

| Southern Plains | Shawnee, Oklahoma | (405) 273-0317 |

| Southwest | Albuquerque, New Mexico | (505) 563-3334 |

| Western | Phoenix, Arizona | (602) 379-4299 |

12 REGIONS

For data regarding your Private Indian Money (IIM) account, you lot may contact the Role of the Special Trustee for American Indians (OST), Trust Casher Call Center, toll-free at (888) 678-6836 ext. 0 or visit their website at www.doi.gov/ost.

Delight visit our website for contact information on the Office of Hearings and Appeals (OHA), Hearing Function locations and a PDF version of the BIA Tribal Leaders Directory. The BIA Tribal Leaders Directory contains contact information for BIA region/agency offices and contact data for the tribes in each BIA Region. (Table of Contents)

Definitions:

The following definitions are from 25 CFR part xv and 43 CFR part thirty.

Administrative police judge (ALJ) means an authoritative law guess with the Function of Hearings and Appeals appointed nether the Administrative Procedure Human action, 5 The statesC. 3105.

Affidavit means a written proclamation of facts by a person that is signed by that person, swearing or affirming under penalty of perjury that the facts declared are truthful and correct to the best of that person's noesis and belief.

Agency means:

(1) The Bureau of Indian Affairs (BIA) agency office, or any other designated role in BIA, having jurisdiction over trust or restricted land and trust personalty; and

(2) Any office of a tribe that has entered into a contract or compact to fulfill the probate office under 25 The statesC. 450f or 458cc.

Chaser Decision Maker (ADM) ways an attorney with OHA who conducts a summary probate proceeding and renders a determination that is subject field to de novo review by an administrative law judge or Indian probate approximate.

BIA ways the Bureau of Indian Affairs inside the Department of the Interior.

Lath means the Interior Board of Indian Appeals within OHA.

Creditor means any individual or entity that has a claim for payment from a decedent's estate.

Decedent means a person who is deceased.

Decision or lodge (or decision and order) ways:

(1) A written document issued past a estimate making determinations as to heirs, wills, devisees, and the claims of creditors, and ordering distribution of trust or restricted land or trust personalty;

(ii) The decision issued by an attorney determination maker in a summary probate proceeding; or

(3) A decision issued by a judge finding that the evidence is insufficient to determine that a person is dead by reason of unexplained absence.

Section means the Department of the Interior.

Devise means a gift of belongings past volition. Besides, to give property past will.

Devisee means a person or entity that receives belongings nether a will.

DPES means the Sectionalization of Probate & Estate Services within the Agency of Indian Affairs.

Estate means the trust or restricted country and trust personalty endemic by the decedent at the fourth dimension of decease.

Formal probate proceeding means a proceeding, conducted by a judge, in which testify is obtained through the testimony of witnesses and the receipt of relevant documents.

Heir ways whatever individual or entity eligible to receive holding from a decedent in an intestate proceeding.

Private Indian Money (IIM) Account ways an interest begetting account for trust funds held by the Secretarial assistant that belong to a person who has an interest in trust assets. These accounts are under the command and management of the Secretary.

Indian means, for the purposes of the Act, any of the following:

(1) Any person who is a member of a federally recognized Indian tribe is eligible to become a fellow member of any federally recognized Indian tribe, or is an owner (as of October 27, 2004) of a trust or restricted interest in land;

(2) Any person meeting the definition of Indian under 25 UsC. 479; or

(3) With respect to the inheritance and ownership of trust or restricted country in the State of California under 25 U.S.C. 2206, any person described in paragraph (1) or (2) of this definition or any person who owns a trust or restricted interest in a parcel of such state in that Land.

Interested political party means:

(1) Whatever potential or actual heir;

(2) Any devisee under a volition;

(3) Any person or entity asserting a claim against a decedent'south manor;

(4) Whatsoever tribe having a statutory choice to purchase the trust or restricted holding interest of a decedent; or

(5) A co-owner exercising a purchase choice.

Intestate means that the decedent died without a valid will as determined in the probate proceeding.

Judge means an Administrative Constabulary Judge or Indian Probate Approximate with OHA.

LTRO means the Land Titles and Records Office within BIA.

Minor means an individual who has not reached the age of majority as defined by the applicable constabulary.

OHA means the Office of Hearings and Appeals within the Department of the Interior.

OST ways the Part of the Special Trustee for American Indians within the Section of the Interior.

Probate means the legal procedure by which applicable tribal, Federal, or Land constabulary that affects the distribution of a decedent's estate is practical in society to:

(i) Make up one's mind the heirs;

(2) Determine the validity of wills and determine devisees;

(3) Determine whether claims confronting the estate will exist paid from trust personalty; and

(4) Gild the transfer of any trust or restricted land or trust personalty to the heirs, devisees, or other persons or entities entitled by law to receive them.

Restricted property means real property, the title to which is held by an Indian but which cannot be alienated or encumbered without the Secretary'due south consent. For the purpose of probate proceedings, restricted property is treated as if it were trust holding. Except as the law may provide otherwise, the term "restricted belongings" as used in this part does not include the restricted lands of the Five Civilized Tribes of Oklahoma or the Osage Nation.

Secretary means the Secretary of the Interior or an authorized representative.

Summary probate proceeding means the consideration of a probate file without a hearing. A summary probate proceeding may exist conducted if the estate involves only an IIM account that did not exceed $five,000 in value on the date of the decedent's death.

Superintendent means a BIA Superintendent or other BIA official, including a field representative or one holding equivalent potency.

Testate ways that the decedent executed a valid will every bit determined in the probate proceeding.

Testator means a person who has executed a valid will as determined in the probate proceeding.

Trust personalty ways all tangible personal property, funds, and securities of whatsoever kind that are held in trust in an IIM account or otherwise supervised by the Secretary.

Trust holding ways existent or personal property, or an interest therein, the title to which is held in trust past the United States for the benefit of an private Indian or tribe.

Will ways a written testamentary certificate that was executed by the decedent and attested to by 2 disinterested adult witnesses, and that states who will receive the decedent'south trust or restricted holding. (Table of Contents)

You lot may telephone call or visit your local BIA Agency function, Tribal Probate Program office, Part of the Special Trustee for American Indians (OST) or Office of Hearings and Appeals (OHA) office for more information

crooksofamidentam.blogspot.com

Source: https://www.bia.gov/bia/ots/dop/your-land

0 Response to "Typically How Much Is Allowed Family Member Allowance in Probate Idaho"

Post a Comment