4. what type of assets requires adjusting entries to record depreciation?

The Adjustment Procedure

21 Record and Post the Common Types of Adjusting Entries

Before showtime adjusting entry examples for Press Plus, let'southward consider some rules governing adjusting entries:

- Every adjusting entry will take at least one income statement business relationship and one balance sail business relationship.

- Cash will never be in an adjusting entry.

- The adjusting entry records the change in amount that occurred during the menstruation.

What are "income statement" and "balance sheet" accounts? Income statement accounts include revenues and expenses. Balance canvass accounts are assets, liabilities, and stockholders' disinterestedness accounts, since they announced on a rest canvass. The second rule tells u.s.a. that cash can never be in an adjusting entry. This is true because paying or receiving cash triggers a journal entry. This means that every transaction with cash will be recorded at the time of the exchange. We will not get to the adjusting entries and have cash paid or received which has not already been recorded. If accountants discover themselves in a situation where the cash business relationship must be adjusted, the necessary adjustment to cash volition be a correcting entry and not an adjusting entry.

With an adjusting entry, the amount of change occurring during the period is recorded. For instance, if the supplies account had a $300 residual at the start of the calendar month and $100 is still available in the supplies business relationship at the end of the calendar month, the company would record an adjusting entry for the $200 used during the calendar month (300 – 100). Similarly for unearned revenues, the company would record how much of the revenue was earned during the period.

Allow's now consider new transaction information for Press Plus.

Earnings Management

Recording adjusting entries seems so cut and dry out. It looks like you just follow the rules and all of the numbers come up out 100 percent right on all financial statements. But in reality this is not e'er the case. Just the fact that you take to make estimates in some cases, such every bit depreciation estimating residue value and useful life, tells you that numbers will not be 100 percent correct unless the accountant has ESP. Some companies engage in something called earnings management, where they follow the rules of accounting mostly just they stretch the truth a little to make information technology expect like they are more than profitable. Some companies practise this past recording revenue before they should. Others leave assets on the books instead of expensing them when they should to decrease full expenses and increase turn a profit.

Take United mexican states-based dwelling-building company Desarrolladora Homex S.A.B. de C.Five. This company reported revenue earned on more than 100,000 homes they had not even build yet. The SEC's complaint states that Homex reported revenues from a project site where every planned abode was said to have been "congenital and sold by December. 31, 2011. Satellite images of the projection site on March 12, 2012, show it was still largely undeveloped and the vast majority of supposedly sold homes remained unbuilt."1

Is managing your earnings illegal? In some situations it is just an unethical stretch of the truth easy enough to do because of the estimates fabricated in adjusting entries. You can simply change your estimate and insist the new estimate is actually better when perhaps information technology is your way to improve the bottom line, for example, changing your annual depreciation expense calculated on expensive found avails from assuming a 10-year useful life, a reasonable estimated expectation, to a twenty-year useful life, not then reasonable but you insist your company will be able to utilize these assets twenty years while knowing that is a slim possibility. Doubling the useful life will cause 50% of the depreciation expense you would have had. This volition brand a positive affect on net income. This method of earnings management would probably non be considered illegal but is definitely a breach of ideals. In other situations, companies manage their earnings in a fashion that the SEC believes is bodily fraud and charges the company with the illegal activity.

Recording Common Types of Adjusting Entries

Remember the transactions for Printing Plus discussed in Analyzing and Recording Transactions.

| Jan. iii, 2019 | issues $20,000 shares of common stock for cash |

| Jan. v, 2019 | purchases equipment on account for $iii,500, payment due inside the month |

| Jan. 9, 2019 | receives $4,000 greenbacks in accelerate from a customer for services not yet rendered |

| Jan. 10, 2019 | provides $5,500 in services to a client who asks to exist billed for the services |

| Jan. 12, 2019 | pays a $300 utility bill with cash |

| Jan. xiv, 2019 | distributed $100 cash in dividends to stockholders |

| Jan. 17, 2019 | receives $2,800 cash from a client for services rendered |

| Jan. 18, 2019 | paid in full, with cash, for the equipment purchase on January 5 |

| Jan. 20, 2019 | paid $3,600 cash in salaries expense to employees |

| January. 23, 2019 | received cash payment in total from the customer on the January 10 transaction |

| Jan. 27, 2019 | provides $1,200 in services to a client who asks to exist billed for the services |

| Jan. 30, 2019 | purchases supplies on account for $500, payment due inside three months |

On Jan 31, 2019, Printing Plus makes adjusting entries for the following transactions.

- On January 31, Printing Plus took an inventory of its supplies and discovered that $100 of supplies had been used during the month.

- The equipment purchased on January 5 depreciated $75 during the month of January.

- Printing Plus performed $600 of services during January for the customer from the January 9 transaction.

- Reviewing the company banking company statement, Printing Plus discovers $140 of interest earned during the month of January that was previously uncollected and unrecorded.

- Employees earned $ane,500 in salaries for the period of January 21–January 31 that had been previously unpaid and unrecorded.

We now tape the adjusting entries from January 31, 2019, for Press Plus.

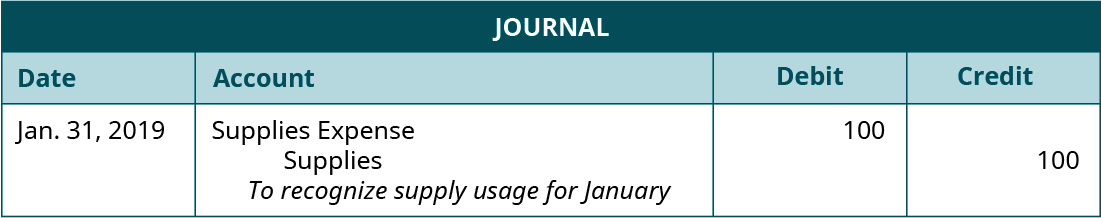

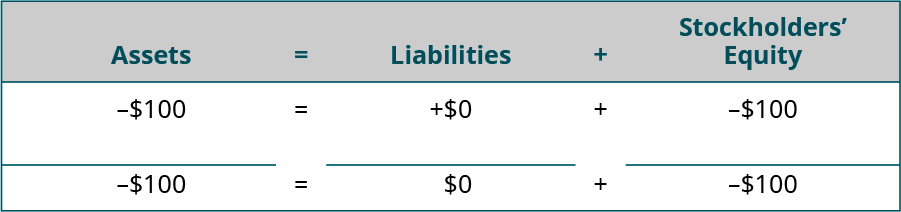

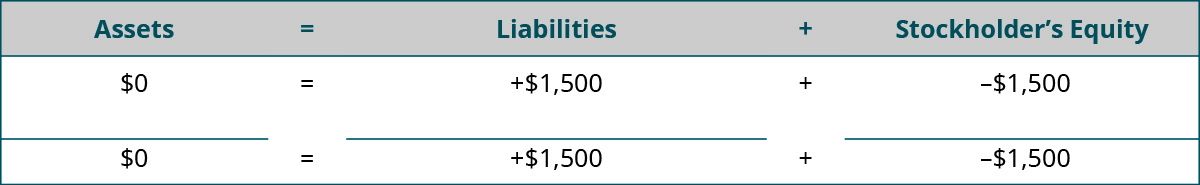

Transaction 13: On January 31, Press Plus took an inventory of its supplies and discovered that $100 of supplies had been used during the month.

Analysis:

- $100 of supplies were used during January. Supplies is an nugget that is decreasing (credit).

- Supplies is a blazon of prepaid expense that, when used, becomes an expense. Supplies Expense would increase (debit) for the $100 of supplies used during January.

Impact on the financial statements: Supplies is a remainder sheet account, and Supplies Expense is an income statement account. This satisfies the rule that each adjusting entry will comprise an income statement and balance canvass account. Nosotros see total assets subtract by $100 on the balance sheet. Supplies Expense increases overall expenses on the income argument, which reduces net income.

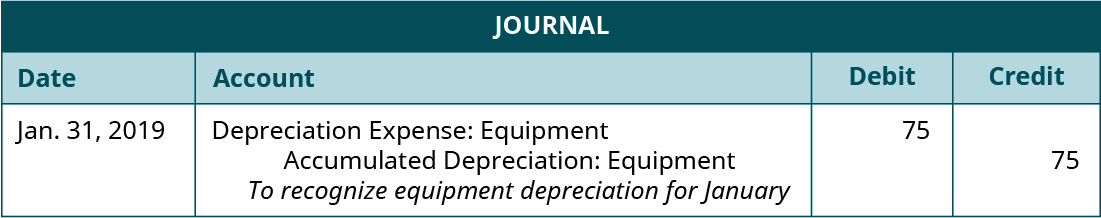

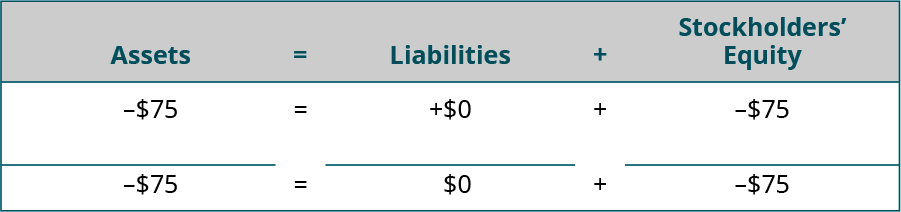

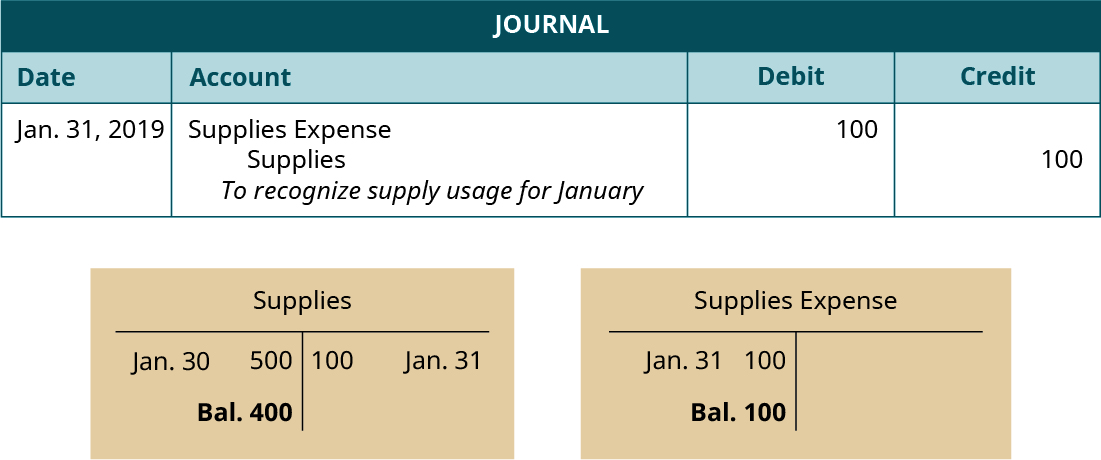

Transaction fourteen: The equipment purchased on January v depreciated $75 during the month of Jan.

Analysis:

- Equipment lost value in the corporeality of $75 during Jan. This depreciation volition bear upon the Accumulated Depreciation–Equipment business relationship and the Depreciation Expense–Equipment account. While we are non doing depreciation calculations here, you will come across more than circuitous calculations in the futurity.

- Accumulated Depreciation–Equipment is a contra asset business relationship (contrary to Equipment) and increases (credit) for $75.

- Depreciation Expense–Equipment is an expense business relationship that is increasing (debit) for $75.

Bear upon on the financial statements: Accumulated Depreciation–Equipment is a contra account to Equipment. When calculating the book value of Equipment, Accumulated Depreciation–Equipment volition be deducted from the original cost of the equipment. Therefore, total assets will subtract by $75 on the balance sheet. Depreciation Expense volition increase overall expenses on the income statement, which reduces net income.

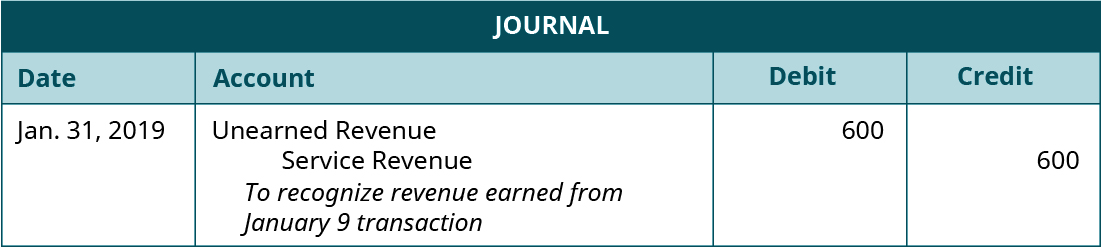

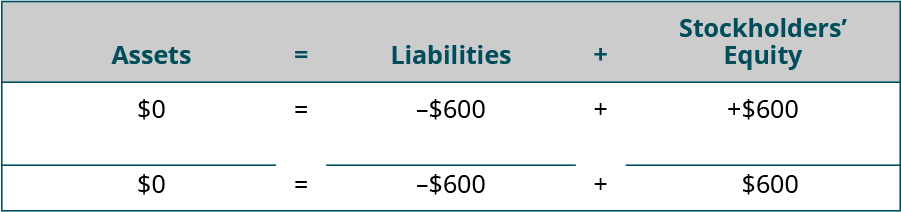

Transaction 15: Printing Plus performed $600 of services during January for the customer from the Jan nine transaction.

Assay:

- The customer from the January 9 transaction gave the company $4,000 in advanced payment for services. By the end of January the company had earned $600 of the advanced payment. This ways that the company nevertheless has yet to provide $3,400 in services to that customer.

- Since some of the unearned revenue is at present earned, Unearned Acquirement would decrease. Unearned Revenue is a liability account and decreases on the debit side.

- The company can now recognize the $600 as earned revenue. Service Acquirement increases (credit) for $600.

Impact on the financial statements: Unearned revenue is a liability account and will decrease total liabilities and equity by $600 on the residuum canvas. Service Acquirement volition increase overall acquirement on the income statement, which increases net income.

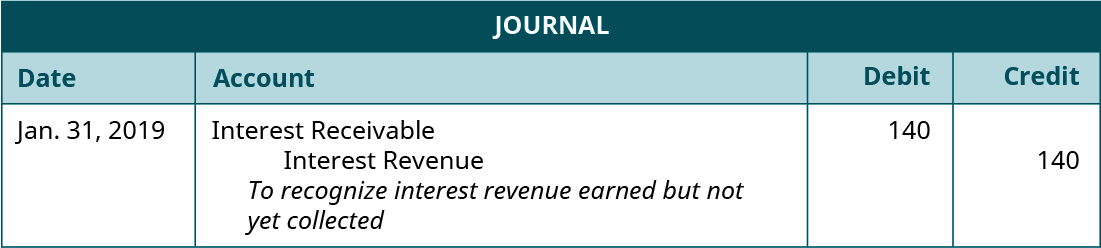

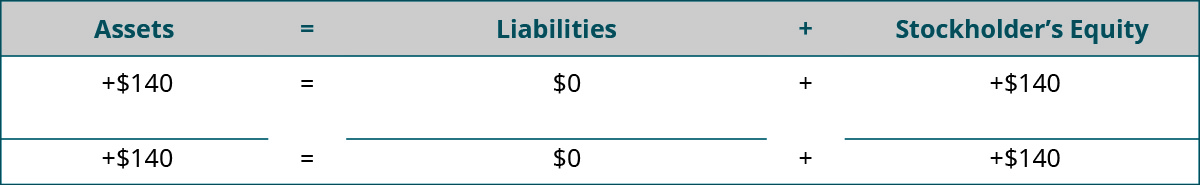

Transaction 16: Reviewing the company bank statement, Printing Plus discovers $140 of interest earned during the calendar month of Jan that was previously uncollected and unrecorded.

Analysis:

- Interest is revenue for the company on money kept in a savings account at the bank. The company only sees the bank statement at the end of the month and needs to record interest revenue that has not however been collected or recorded.

- Interest Revenue is a revenue business relationship that increases (credit) for $140.

- Since Printing Plus has yet to collect this interest revenue, information technology is considered a receivable. Involvement Receivable increases (debit) for $140.

Bear on on the financial statements: Interest Receivable is an asset business relationship and will increase total assets by $140 on the balance sheet. Interest Acquirement will increase overall acquirement on the income statement, which increases cyberspace income.

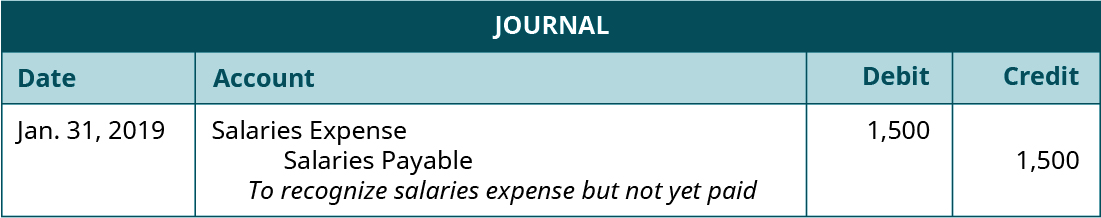

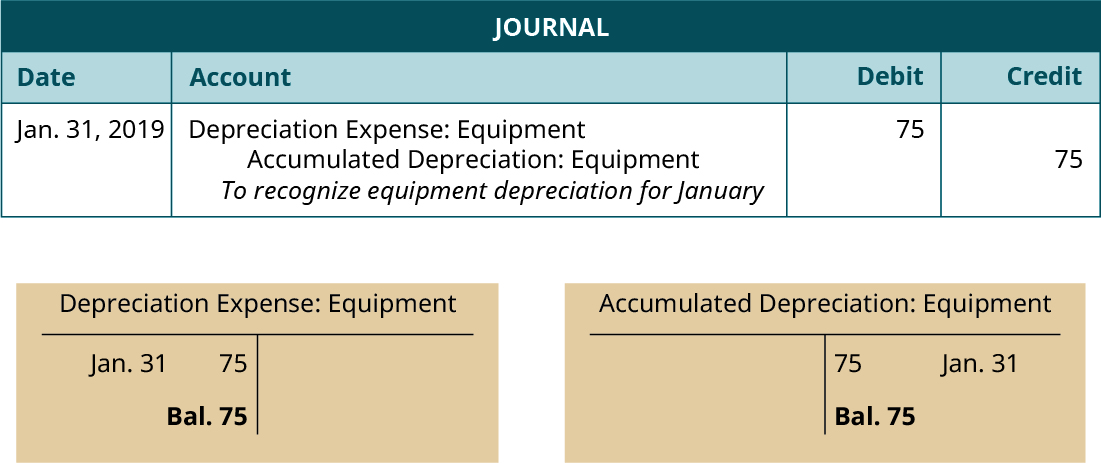

Transaction 17: Employees earned $ane,500 in salaries for the catamenia of January 21–January 31 that had been previously unpaid and unrecorded.

Analysis:

- Salaries take accumulated since January 21 and will non be paid in the electric current menstruation. Since the salaries expense occurred in Jan, the expense recognition principle requires recognition in Jan.

- Salaries Expense is an expense account that is increasing (debit) for $i,500.

- Since the company has not yet paid salaries for this time period, Printing Plus owes the employees this money. This creates a liability for Printing Plus. Salaries Payable increases (credit) for $i,500.

Impact on the financial statements: Salaries Payable is a liability account and will increase full liabilities and equity by $1,500 on the balance sheet. Salaries expense volition increase overall expenses on the income argument, which decreases net income.

We now explore how these adjusting entries impact the general ledger (T-accounts).

Deferrals versus Accruals

Characterization each of the post-obit as a deferral or an accrual, and explain your respond.

- The company recorded supplies usage for the calendar month.

- A client paid in advance for services, and the visitor recorded revenue earned afterward providing service to that customer.

- The company recorded salaries that had been earned by employees but were previously unrecorded and accept not yet been paid.

Solution

- The company is recording a deferred expense. The company was deferring the recognition of supplies from supplies expense until it had used the supplies.

- The company has deferred revenue. It deferred the recognition of the revenue until it was actually earned. The customer already paid the cash and is currently on the balance sheet as a liability.

- The visitor has an accrued expense. The company is bringing the salaries that have been incurred, added up since the concluding paycheck, onto the books for the first time during the adjusting entry. Cash will be given to the employees at a later on time.

Several internet sites can provide additional information for you on adjusting entries. One very proficient site where you can notice many tools to help you lot study this topic is Accounting Passenger vehicle which provides a tool that is available to you free of charge. Visit the website and accept a quiz on accounting nuts to test your knowledge.

Posting Adjusting Entries

One time you accept journalized all of your adjusting entries, the next pace is posting the entries to your ledger. Posting adjusting entries is no dissimilar than posting the regular daily journal entries. T-accounts will be the visual representation for the Printing Plus general ledger.

Transaction xiii: On January 31, Press Plus took an inventory of its supplies and discovered that $100 of supplies had been used during the month.

Periodical entry and T-accounts:

In the periodical entry, Supplies Expense has a debit of $100. This is posted to the Supplies Expense T-account on the debit side (left side). Supplies has a credit remainder of $100. This is posted to the Supplies T-account on the credit side (right side). You lot will discover there is already a debit remainder in this account from the purchase of supplies on January thirty. The $100 is deducted from $500 to become a final debit balance of $400.

Transaction 14: The equipment purchased on January five depreciated $75 during the month of January.

Journal entry and T-accounts:

In the journal entry, Depreciation Expense–Equipment has a debit of $75. This is posted to the Depreciation Expense–Equipment T-account on the debit side (left side). Accumulated Depreciation–Equipment has a credit balance of $75. This is posted to the Accumulated Depreciation–Equipment T-account on the credit side (right side).

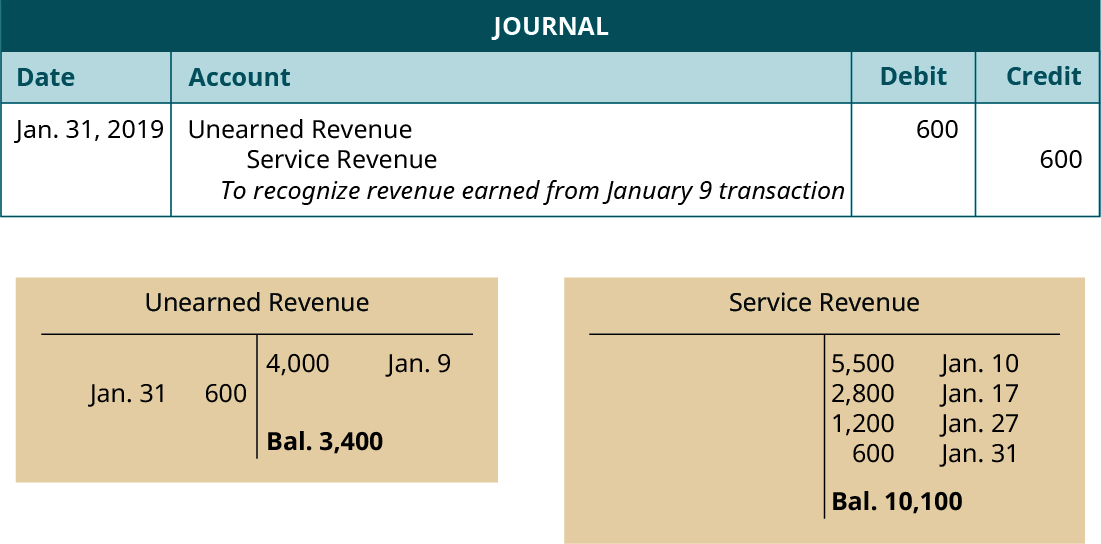

Transaction xv: Printing Plus performed $600 of services during January for the customer from the January 9 transaction.

Periodical entry and T-accounts:

In the journal entry, Unearned Revenue has a debit of $600. This is posted to the Unearned Revenue T-account on the debit side (left side). You volition find there is already a credit balance in this account from the Jan ix customer payment. The $600 debit is subtracted from the $4,000 credit to get a final balance of $3,400 (credit). Service Acquirement has a credit balance of $600. This is posted to the Service Acquirement T-business relationship on the credit side (right side). Y'all will notice there is already a credit residual in this account from other acquirement transactions in January. The $600 is added to the previous $9,500 rest in the account to get a new terminal credit balance of $10,100.

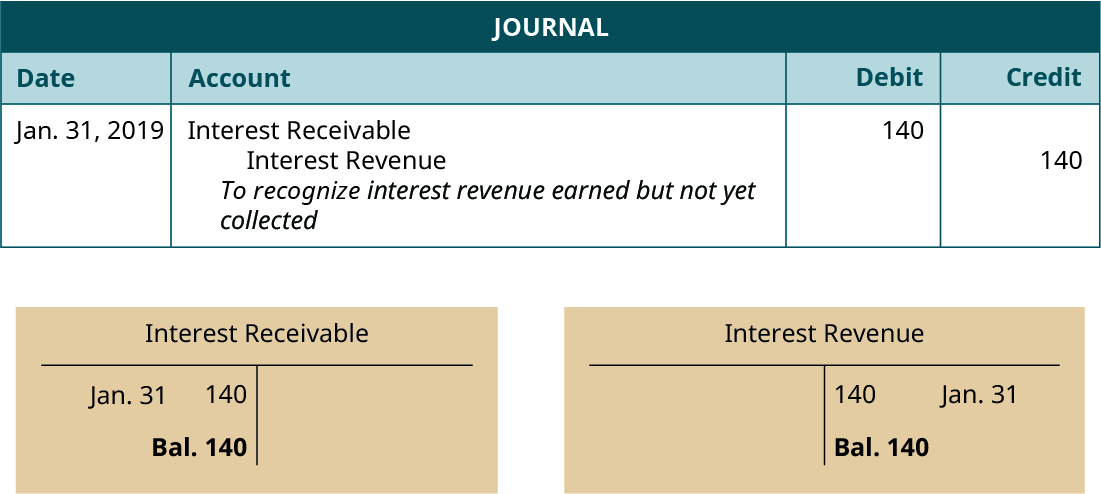

Transaction 16: Reviewing the visitor bank statement, Printing Plus discovers $140 of interest earned during the month of January that was previously uncollected and unrecorded.

Periodical entry and T-accounts:

In the journal entry, Interest Receivable has a debit of $140. This is posted to the Involvement Receivable T-account on the debit side (left side). Interest Revenue has a credit residue of $140. This is posted to the Interest Revenue T-account on the credit side (right side).

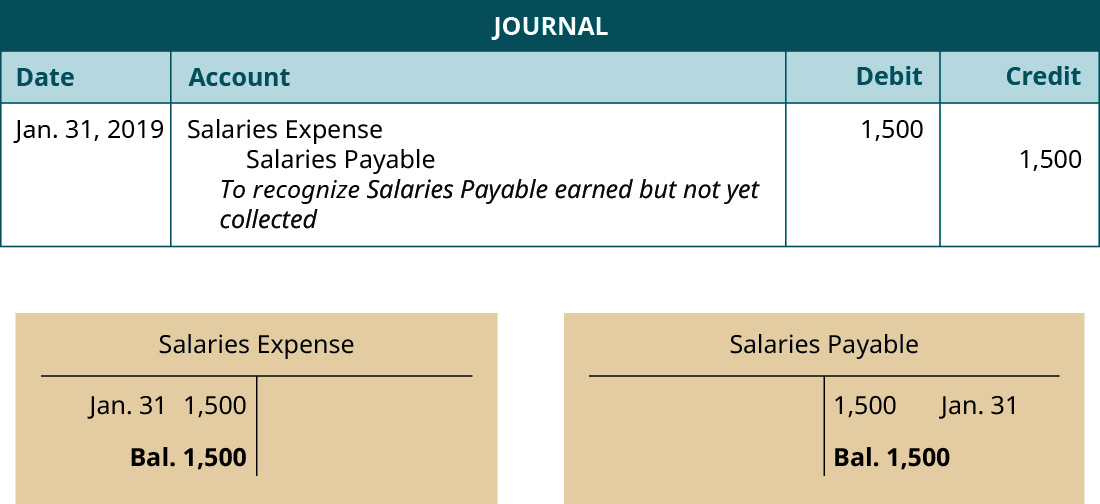

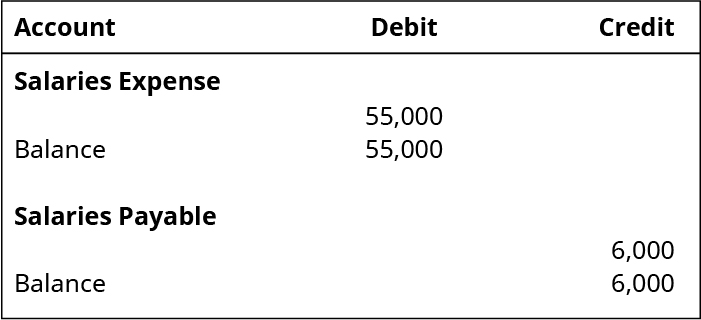

Transaction 17: Employees earned $1,500 in salaries for the menses of Jan 21–Jan 31 that had been previously unpaid and unrecorded.

Journal entry and T-accounts:

In the periodical entry, Salaries Expense has a debit of $1,500. This is posted to the Salaries Expense T-business relationship on the debit side (left side). You will notice there is already a debit residuum in this account from the January 20 employee bacon expense. The $1,500 debit is added to the $3,600 debit to get a last balance of $5,100 (debit). Salaries Payable has a credit residuum of $1,500. This is posted to the Salaries Payable T-account on the credit side (right side).

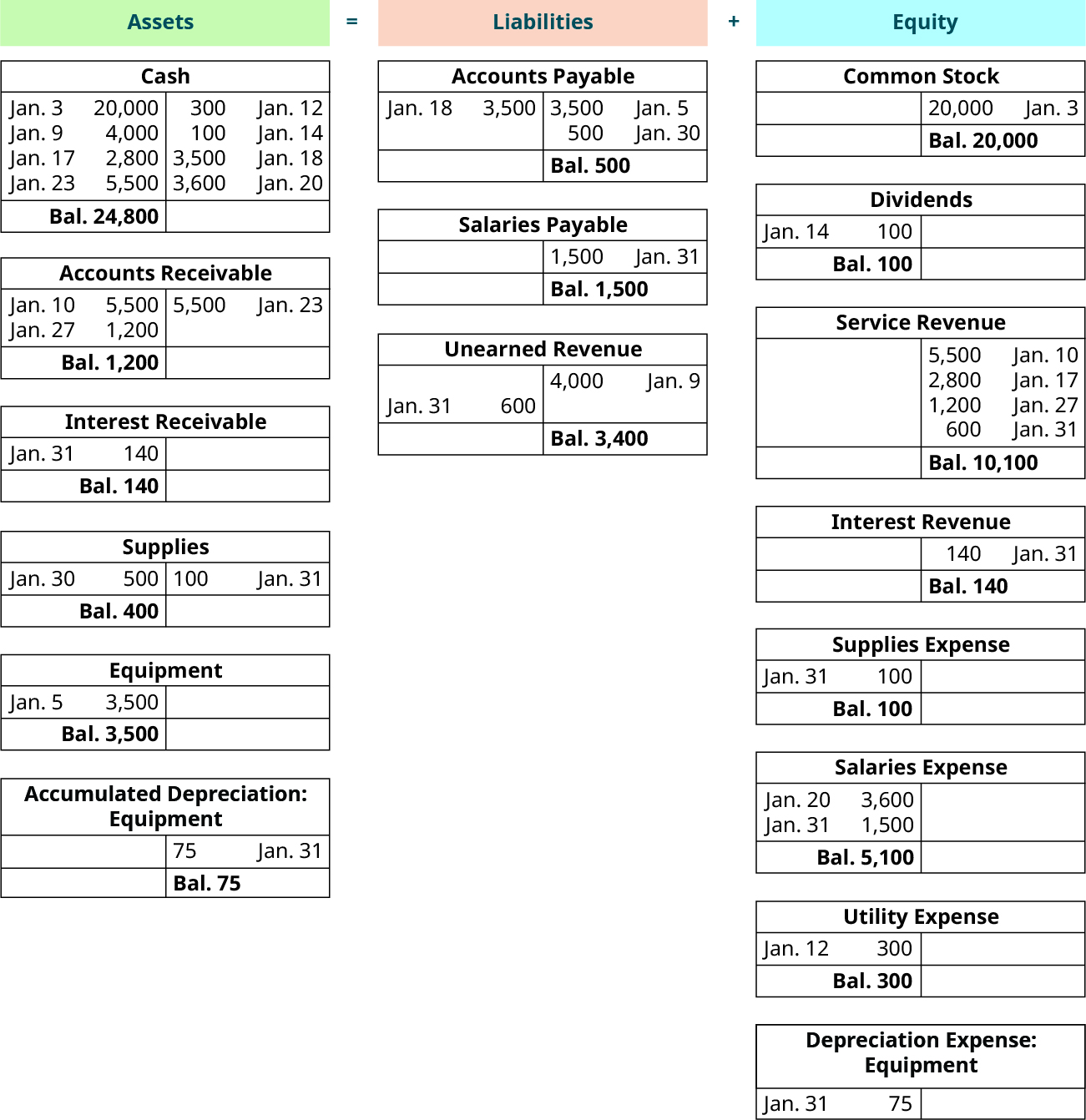

T-accounts Summary

Once all adjusting journal entries have been posted to T-accounts, we tin can check to make sure the accounting equation remains balanced. Following is a summary showing the T-accounts for Printing Plus including adjusting entries.

Press Plus summary of T-accounts with Adjusting Entries. (attribution: Copyright Rice Academy, OpenStax, under CC Past-NC-SA 4.0 license)

The sum on the avails side of the accounting equation equals $29,965, found past calculation together the terminal balances in each asset account (24,800 + 1,200 + 140 + 400 + 3,500 – 75). To find the total on the liabilities and equity side of the equation, we demand to find the difference between debits and credits. Credits on the liabilities and equity side of the equation total $35,640 (500 + one,500 + three,400 + xx,000 + 10,100 + 140). Debits on the liabilities and disinterestedness side of the equation total $5,675 (100 + 100 + five,100 + 300 + 75). The deviation between $35,640 – $5,675 = $29,965. Thus, the equation remains balanced with $29,965 on the nugget side and $29,965 on the liabilities and equity side. Now that we accept the T-account data, and have confirmed the accounting equation remains counterbalanced, we can create the adjusted trial balance in our 6th stride in the accounting cycle.

When posting any kind of periodical entry to a general ledger, it is important to have an organized system for recording to avoid any account discrepancies and misreporting. To exercise this, companies can streamline their full general ledger and remove whatsoever unnecessary processes or accounts. Check out this article "Encourage General Ledger Efficiency" from the Journal of Accountancy that discusses some strategies to improve general ledger efficiency.

Key Concepts and Summary

- Rules for adjusting entries: The rules for recording adjusting entries are as follows: every adjusting entry will take one income statement account and i residuum sheet account, cash will never be in an adjusting entry, and the adjusting entry records the alter in amount that occurred during the catamenia.

- Posting adjusting entries: Posting adjusting entries is the aforementioned process every bit posting general journal entries. The boosted adjustments may add accounts to the end of the menses or may change business relationship balances from the earlier periodical entry step in the accounting cycle.

Multiple Pick

(Effigy)What adjusting periodical entry is needed to record depreciation expense for the period?

- a debit to Depreciation Expense; a credit to Greenbacks

- a debit to Accumulated Depreciation; a credit to Depreciation Expense

- a debit to Depreciation Expense; a credit to Accumulated Depreciation

- a debit to Accumulated Depreciation; a credit to Greenbacks

(Effigy)Which of these transactions requires an adjusting entry (debit) to Unearned Revenue?

- revenue earned but not nonetheless collected

- acquirement nerveless but not notwithstanding earned

- revenue earned before being collected, when it is later collected

- revenue collected earlier existence earned, when information technology is later earned

Questions

(Effigy)If the Supplies account had an catastrophe balance of $ane,200 and the actual count for the remaining supplies was $400 at the end of the menstruum, what aligning would be needed?

An entry to adjust the supplies account to the $400 balance is needed; Debit Supplies Expense for 800; Credit Supplies for 800.

(Figure)When a visitor collects greenbacks from customers before performing the contracted service, what is the impact, and how should information technology be recorded?

(Figure)If the Prepaid Insurance account had a balance of $12,000, representing i yr's policy premium, which was paid on July i, what entry would exist needed to adjust the Prepaid Insurance account at the end of December, before preparing the financial statements?

An entry to suit the Prepaid Insurance business relationship to $6,000 balance is needed; Debit Insurance Expense for six,000; Credit Prepaid Insurance for 6,000.

(Figure)If adjusting entries include these listed accounts, what other account must be in that entry every bit well? (A) Depreciation expense; (B) Unearned Service Revenue; (C) Prepaid Insurance; (D) Interest Payable.

Exercise Set A

(Effigy)Reviewing insurance policies revealed that a single policy was purchased on August 1, for one year's coverage, in the amount of $vi,000. There was no previous remainder in the Prepaid Insurance account at that time. Based on the information provided:

- Make the December 31 adjusting journal entry to bring the balances to correct.

- Show the impact that these transactions had.

(Figure)On July 1, a customer paid an accelerate payment (servant) of $5,000 to cover future legal services. During the period, the visitor completed $3,500 of the agreed-on services for the client. There was no beginning balance in the Unearned Revenue account for the period. Based on the data provided,

- Brand the December 31 adjusting journal entry to bring the balances to correct.

- Show the touch on that these transactions had.

(Figure)Reviewing payroll records indicates that employee salaries that are due to exist paid on Jan iii include $3,575 in wages for the last week of December. There was no previous balance in the Salaries Payable business relationship at that time. Based on the information provided, make the December 31 adjusting journal entry to bring the balances to correct.

(Figure)Supplies were purchased on January 1, to be used throughout the twelvemonth, in the amount of $eight,500. On December 31, a concrete count revealed that the remaining supplies totaled $1,200. There was no get-go of the year balance in the Supplies account. Based on the information provided:

- Create journal entries for the original transaction

- Create journal entries for the December 31 adjustment needed to bring the balances to correct

- Prove the activity, with ending balance

(Figure)Prepare journal entries to tape the following concern transaction and related adjusting entry.

- January 12, purchased supplies for greenbacks, to be used all year, $3,850

- December 31, physical count of remaining supplies, $800

(Effigy)Prepare periodical entries to record the following adjustments.

- Insurance that expired this catamenia, $18,000

- Depreciation on assets, $4,800

- Salaries earned past employees but unpaid, $1,200

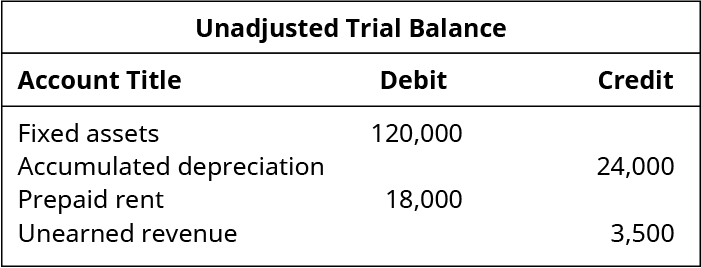

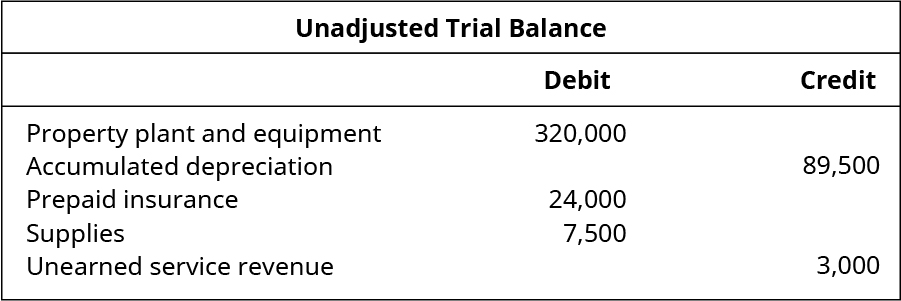

(Figure)Prepare adjusting periodical entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data.

- depreciation on fixed avails, $ viii,500

- unexpired prepaid hire, $12,500

- remaining balance of unearned revenue, $555

Practise Set B

(Effigy)Reviewing insurance policies revealed that a single policy was purchased on March 1, for one year's coverage, in the amount of $9,000. There was no previous residual in the Prepaid Insurance account at that time. Based on the data provided,

- Brand the December 31 adjusting journal entry to bring the balances to correct.

- Show the touch that these transactions had.

(Figure)On September 1, a visitor received an advance rental payment of $12,000, to comprehend six months' hire on an part building. There was no start balance in the Unearned Rent account for the period. Based on the information provided,

- Make the December 31 adjusting journal entry to bring the balances to correct.

- Bear witness the impact that these transactions had.

(Figure)Reviewing payroll records indicates that one-fifth of employee salaries that are due to exist paid on the first payday in January, totaling $15,000, are actually for hours worked in December. In that location was no previous balance in the Salaries Payable business relationship at that time. Based on the information provided, make the December 31 adjusting journal entry to bring the balances to correct.

(Effigy)On July 1, a client paid an advance payment (servant) of $10,000, to cover time to come legal services. During the menses, the company completed $6,200 of the agreed-on services for the client. There was no beginning balance in the Unearned Revenue account for the period. Based on the information provided, make the journal entries needed to bring the balances to right for:

- original transaction

- December 31 aligning

(Figure)Prepare periodical entries to record the business transaction and related adjusting entry for the post-obit:

- March 1, paid greenbacks for one year premium on insurance contract, $18,000

- December 31, remaining unexpired balance of insurance, $iii,000

(Effigy)Fix periodical entries to record the following adjustments:

- revenue earned but non nerveless, nor recorded, $14,000

- revenue earned that had originally been nerveless in accelerate, $viii,500

- taxes due but not yet paid, $ two,750

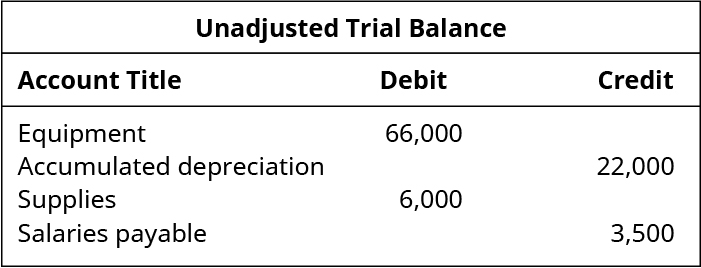

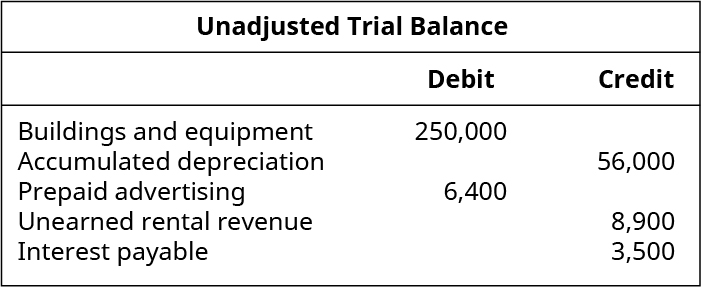

(Figure)Gear up adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial residue and the adjustment data.

- amount due for employee salaries, $4,800

- actual count of supplies inventory, $ ii,300

- depreciation on equipment, $3,000

Problem Set A

(Figure)Using the following information:

- make the December 31 adjusting journal entry for depreciation

- decide the net book value (NBV) of the asset on December 31

- Cost of nugget, $250,000

- Accumulated depreciation, kickoff of year, $80,000

- Electric current year depreciation, $25,000

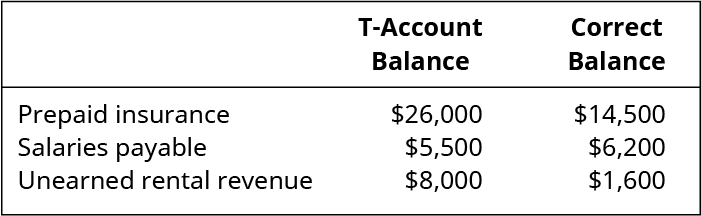

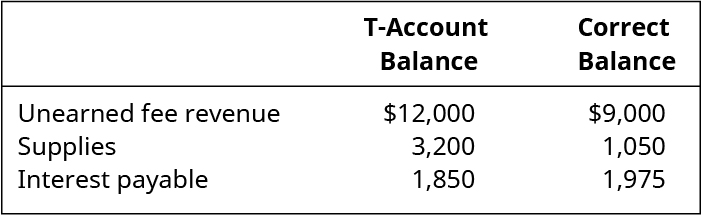

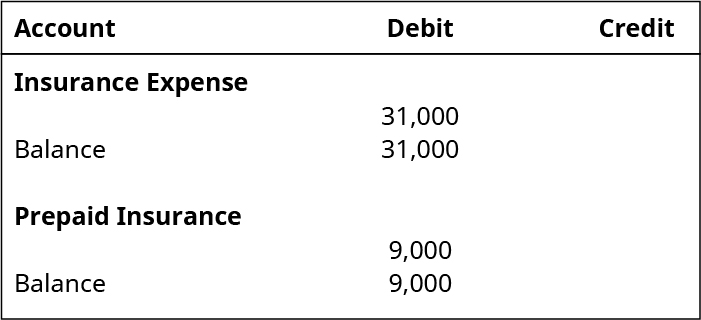

(Effigy)Use the following account T-balances (assume normal balances) and correct balance data to make the Dec 31 adjusting journal entries.

(Figure)Apply the post-obit business relationship T-balances (assume normal balances) and correct residue data to make the December 31 adjusting journal entries.

(Figure)Prepare journal entries to record the post-obit transactions. Create a T-business relationship for Interest Payable, post any entries that bear upon the account, and tally the ending balance for the account (assume Involvement Payable beginning balance of $ii,500).

- March 1, paid interest due on annotation, $2,500

- December 31, interest accrued on note payable, $4,250

(Figure)Set journal entries to tape the post-obit transactions. Create a T-business relationship for Prepaid Insurance, post any entries that affect the account, and tally the ending balance for the business relationship (presume Prepaid Insurance beginning residual of $9,000).

- April 1, paid cash for ane-year policy, $18,000

- December 31, unexpired premiums, $4,500

(Figure)Decide the amount of cash expended for Salaries during the calendar month, based on the entries in the following accounts (assume 0 showtime balances).

(Figure)Fix adjusting journal entries, as needed, considering the business relationship balances excerpted from the unadjusted trial remainder and the adjustment information.

- supplies actual count at year cease, $6,500

- remaining unexpired insurance, $6,000

- remaining unearned service revenue, $1,200

- salaries owed to employees, $2,400

- depreciation on belongings establish and equipment, $18,000

Trouble Fix B

(Figure)Using the following information,

- Make the December 31 adjusting journal entry for depreciation.

- Decide the net book value (NBV) of the asset on December 31.

- Cost of asset, $195,000

- Accumulated depreciation, offset of year, $26,000

- Current twelvemonth depreciation, $13,000

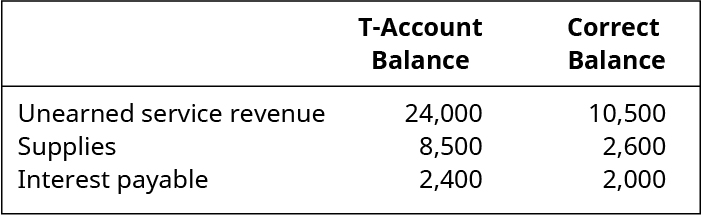

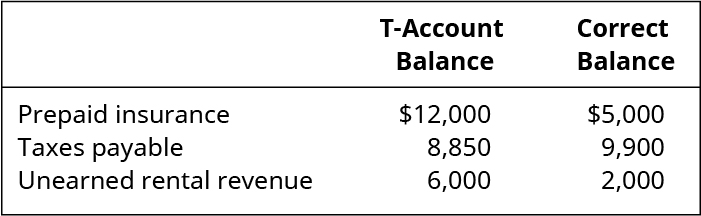

(Figure)Use the following account T-balances (assume normal balances) and correct balance information to brand the December 31 adjusting journal entries.

(Effigy)Apply the following account T-balances (assume normal balances) and correct balance data to brand the Dec 31 adjusting journal entries.

(Figure)Prepare journal entries to record the post-obit transactions. Create a T-business relationship for Supplies, post any entries that touch the account, and tally ending balance for the account (assume Supplies beginning balance of $6,550).

- January 26, purchased additional supplies for cash, $nine,500

- December 31, actual count of supplies, $eight,500

(Figure)Prepare journal entries to record the following transactions. Create a T-account for Unearned Acquirement, post any entries that affect the account, tally catastrophe rest for the account (presume Unearned Revenue starting time balance of $12,500).

- May one, collected an advance payment from client, $15,000

- December 31, remaining unearned advances, $7,500

(Figure)Determine the amount of cash expended for Insurance Premiums during the month, based on the entries in the following accounts (presume 0 outset balances).

(Figure)Fix adjusting journal entries, as needed, because the account balances excerpted from the unadjusted trial remainder and the adjustment data.

- depreciation on buildings and equipment, $17,500

- advertising yet prepaid at yr cease, $2,200

- interest due on notes payable, $four,300

- unearned rental acquirement, $six,900

- interest receivable on notes receivable, $1,200

Thought Provokers

(Figure)Search the spider web for instances of possible venial relating to earnings management. This could be news reports, Securities and Exchange Commission violation reports, fraud charges, or any other source of alleged fiscal argument judgment lapse.

- Write down the name and industry type of the company y'all are discussing.

- Draw the purported indiscretion, and how information technology relates to mis-reporting earnings or shady accounting.

- Estimate the impact of the potential misrepresented amount.

- Note: Yous do non have to accept proof that a compromise occurred, but y'all do need to accept a source of your reporting of the potential trouble.

- Provide the web link to the information you found, to allow accurate verification of your answers.

Footnotes

- 1 U.S. Securities and Substitution Committee. "SEC Charges Mexico-Based Homebuilder in $3.3 Billion Bookkeeping Fraud. Printing Release." March 3, 2017. https://www.sec.gov/news/pressrelease/2017-60.html

crooksofamidentam.blogspot.com

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/record-and-post-the-common-types-of-adjusting-entries/

0 Response to "4. what type of assets requires adjusting entries to record depreciation?"

Post a Comment